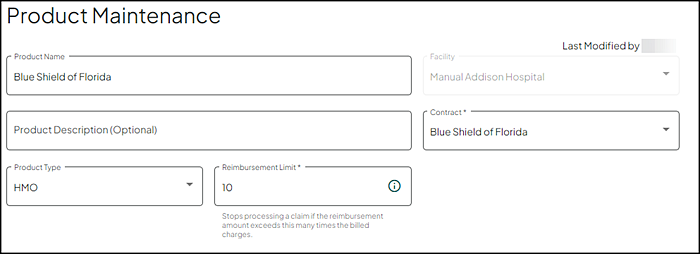

Product Maintenance

The Product Maintenance page allows you to view and edit the insurance product details.

Field Descriptions

The following table describes each of the fields on this page.

|

Field |

Description |

|---|---|

|

Last Modified by |

Displays the user's full name and the date/time the product was last modified. |

|

Product Name |

Enter information into the text box provided (required field). 64 characters maximum. Note: You are prompted with a Product name is required message if this text box is blank. |

|

Facility |

Name of the facility or group of facilities associated with the account. |

|

Product Description |

(Optional) Enter information into the text box provided. 90 character maximum. |

|

Contract |

Make a selection from the drop down list (required field). Displays only contracts associated with your facility. Note: You are prompted with a Contract is required message if this field is blank. |

|

Product Type |

The type of product (examples include HMO, PPO, Indemnity, Medicare, Self Pay, Medicaid, MediCal, TRICARE, or Do Not Process). Make the appropriate selection from the drop down list provided. |

|

Reimbursement Limit |

The maximum rate of reimbursement, expressed as a number. Enter/Update the reimbursement limit. Claim processing stops if the reimbursement amount exceeds the amount entered times the billed charges (10 is the default). |

Non-Covered Charges

Select the appropriate option to govern how Non-Covered Charges are treated when repricing the product.

Note: Hover over any of these options to view the description online via the application.

This option removes the non-covered charges from the billed charges prior to calculating the Expected Insurance Payment and Expected Discount amount, and then the Non-Covered Charge amount is added to the Total Expected Reimbursement.

When Not added to the Total Expected Reimbursement or Discount check box is enabled/checked (default), the non-covered charges are removed from the billed charges prior to calculating the Expected Insurance Payment and Expected Discount, but does not add back to either expected amounts.

When the GA and GY check boxes are enabled/checked (default), the selected G-modifiers are added to the Total Expected Reimbursement or Discount. If G-modifiers are not to be included, disable/uncheck the appropriate check box or check boxes.

This option treats non-covered charges as if they are covered. With this option, non-covered charges are included in calculating the Expected Insurance Payment and are part of gross charges used in calculating the expected discount (ignores that these charges are non-covered).

This option removes the non-covered charges from the billed charges prior to calculating the Expected Insurance Payment and Expected Discount amount, then the Non-Covered Charge amount is added to the Total Expected Discount.

Write-Downs

Note: The write-down section displays only if the facility is utilizing write-downs.

If your facility utilizes write-downs, the Write-Downs section provides a series of questions guiding you through the payor write-down process.

- Select Yes or No indicating if you do or do not want to send write downs for this product.

- If No is selected, the remaining questions do not display as they are not relevant.

- This question only displays if the previous question is answered as Yes.

- Select Yes or No indicating if you do or do not want a write-down sent if the expected reimbursement is $0.00 or to send the write-down for 100% of Gross Charges.

- This question only displays if the first question is answered as Yesand the Product Type is set to Medicare.

- Select Yes or No indicating if you do or do not want the write-down sent for Medicare OPPS claims with claim disposition 204.

Other Product Options

A series of questions display based on your facility type (hospital or physician), and the Product Type selected. These questions guide you through additional product options.

- Default is set to No.

- Select Yes to indicate that claims less than $1.00 are excluded from the reimbursement logic so that these claims are priced and create billing records.

Note: This option does not display for facilities utilizing Claim Level Processing logic.

Use this option to apply the Self-Administered Drug (SAD) logic to Managed Medicare contract profiles. This option only displays for HMO, PPO, Indemnity, and Self-pay product types. Selecting this option indicates the Self Administered Drug (SAD) logic should be set up.

- This option requires a date to be entered in the GY Non-Covered Charge Date field on the Contract Profile Maintenance page. This date indicates that non-covered GY charges are accepted for the given contract. For more information, refer to Maintain Contract Profiles.

- This option is only enabled if you select Not added to calculated expected reimbursement from the Non-Covered Charges list.

- Default is set to No.

- Select Yes to indicate you want this product to use Self Administered Drug (SAD) logic.

Use this option to enable additional line item evaluation of the claim to determine if it is being re-billed with line items previously denied by the payer.

- If the lines match those of a previous claim, the claim is identified as a re-bill of duplicate line items and not priced.

- If the line items do not match those of a previous claim, the claim is priced and will it replace the previous claim with corresponding dates of service.

- Default is set to No.

- Select Yes to indicate you want this product to re-bill as a separate claim.

- Default is set to No.

- Select Yes to indicate you want this product to process all outpatient claims regardless of bill type and not use the standard claim replacement.

- Default is set to No.

- Select Yes to indicate you want this product to process outpatient multi-day claim re-bill as individual day claims?

- Default is set to Yes indicating to price line items with a GA modifier at $0.00 and the full responsibility goes to the patient.

- Select No to indicate that line items with a GA modifier go through the reimbursement tool and price accordingly.

Use this option to allow processing split bill claims so they are recognized as multiple claims from a single episode rather than treated as replacement claims.

- Outpatient Claims - Separate (BILLMAST) records are created for each claim in that episode.

- Inpatient Claims - One (BILLMAST) record is created combining all of the claims in that episode.

- Hospital UB-04 claims use the following criteria. If the values are all the same and the billed charges are different, claims price separately as multiple claims from a single episode.

- Patient Number

- Admit Date

- Service From / Service To Dates

- Plan ID

- Hospital CMS-1500 claims use the following criteria. If the values are all the same and the billed charges are different, claims price separately as multiple claims from a single episode.

- Patient Number

- Admit Date

- Service From / Service To Dates

- Plan ID

- POS

- Provider ID

- Default is set to No.

- Select Yes to indicate you want this product to process split bill claims into multiple claims from a single episode rather than treated as replacement claims.

Note: This option does not display for Professional facilities.

Use this option to process 13x and 14x claims correctly when they have different admit dates and dates of services, or the same admit dates and dates of services for an account, and there is already a BILLMAST record for one of them (13x or 14x).

- A 141 claim with the same admit dates and the same dates of service as a 131 BILLMAST record for an account, process and debrief to a separate BILLMAST record.

- A 141 claim with the same admit dates and different dates of service as a 131 BILLMAST record for an account, process and debrief to a separate BILLMAST record.

- 141 with different admit dates and different dates of service as a 131 BILLMAST record for an account, process and debrief to a separate BILLMAST record.

- Default is set to No.

- Select Yes to indicate you want this product to process 141 and 131 claims with the same admit date separately.

Note: This option does not display for Professional facilities.

Use this option to allow claim level facilities to replace an outpatient claim with an inpatient claim, or an inpatient claim with an outpatient claim for the same or overlapping dates of service. The replacement claim becomes the claim of record.

- When an Inpatient claim is denied and charges are resubmitted on an outpatient claim, the outpatient claim is the claim of record and the account is not overstated by the inpatient claim.

- When an outpatient claim is denied and charges are resubmitted on an inpatient claim, only the inpatient claim is the claim of record and the account is not overstated by the outpatient claim.

- Transactions and remittance advices (RAs) for the claim are matched with billing record regardless of changes from IP to OP or OP to IP.

- Default is set to No.

- Select Yes to indicate you want to require a replacement of an inpatient to outpatient, or outpatient to inpatient claim when the original is denied.

Note: This option may not be applicable for all payors. Please check with your representatives. This option is not designed to be used with late charge (XX5) or interim (XX2, XX3, XX4) claim. Existing accounts are not corrected by an update reprice. To address existing accounts, manually apply a Void override to reverse the replaced claim.

Use this option to process non-Medicare Bill Type 121 claims at the product level for managed care payers.

- Default is set to Does Not Process.

- Select Should replace the Part A claim to indicate that this product processes Managed Care 121 claims.

- Select Process Like Medicare to indicate that this is a Managed Care (non-Medicare) product type that is to process like Medicare.

Note: This option does not display for Professional facilities or Medicare Bill Type 121 claims.